SHOPPING FROM THE COMFORT OF YOUR COUCH… COSTING YOU MORE THAN YOUR WAISTLINE!

For generations we have prepared our own food at home resulting in a more positive impact on our bodies. We were more likely to eat smaller portions, take in fewer kilojoules, less fat, salt and sugar tending to make us healthier in weight and better general health1.

So why are we not cooking as much anymore?…

- WE ARE BUSY

- TOO MUCH CONVENIENCE

Australians are increasingly using apps and online payment methods to shop.

Sadly, for many of us, we use mobile apps to spend money more than we use it to track and manage our money.

Here’s how we spend our money

Australians are spending an average $328 a month on food, movies and music delivered to their doors or downloaded on devices2.

This is purely based on what is delivered to our home without us even leaving the house.

A third of Australians living in capital cities order food through online delivery services such as Menulog, UberEats, Deliveroo and Foodora3.

Even our relaxing Friday night drinks at home is changing. The local ‘bottle-o’ is being replaced by delivery apps like Tipple and Jimmy Brings. We do not need to make a stop on the way home or head to the pub for our grog. With a click of a button, it can be delivered to us in under 30mins4.

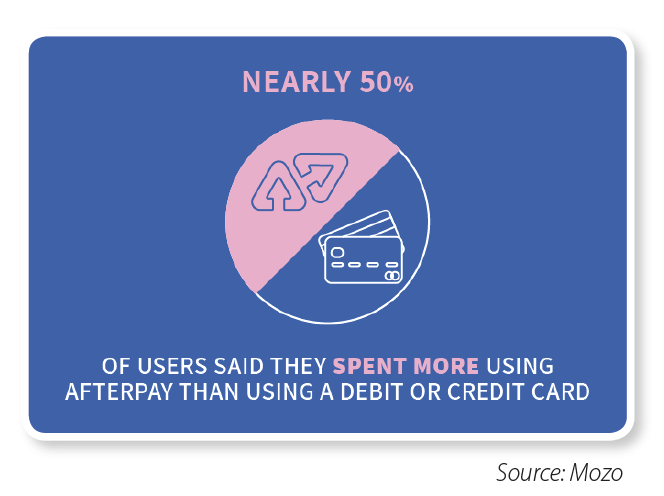

So, if you order in… AND you are adding this to your buy-now-pay-later shopping through Afterpay, Zippay and the like, you could very well jeopardise financing your next loan if not used sensibly.

This is made even more dangerous if you are an impulse buyer prone to overspending. Why? Well…

The facts don’t lie. Users admit that…

30% have missed at least one Afterpay payment – penalties apply

65% said the ability to make smaller payments influenced them to make purchases they wouldn’t normally make5.

Therefore, with our modern busy lifestyles, we are creating a real disconnection with what we are actually spending – convenience spending is making us lazier and unhealthier consumers.

We all know people who live less than a five minute walk from restaurants, yet still order-in!

Why are we concerned?

Because of the sheer transparency of the way we spend our money – ‘Big Brother’ is watching our every move. Along with tighter lending criteria, lenders also have greater visibility over our spending. As your finance specialist we find ourselves spending more time and effort than before to help our clients develop strategies with their finances because many of us are totally disengaged with our actual financial status.

Have you noticed that your bank now groups your transactions into categories such as groceries, utilities, cash out, retail spending etc on your online statement and app?

Lenders use this information and now have the technology to review and evaluate the risks for your loan assessment.

There can be a variety of reasons a lender may reject a loan application

Perhaps you’ve renovated, are paying off holiday expenses on a credit card or have bought a new car. As your finance specialist, we can ensure you are ‘loan application ready’ by favourably drafting your situation to the lender that is most favourable for your circumstances. This is often missed by going directly to the bank yourself.

So… how else can WE help?

Our expertise will help you review your spending and budgeting habits to provide you with the best plan for improving your chances of approval before applying for your next loan.

An accurate assessment of your situation and home loan readiness will help you move forward with confidence.

Sources and links:

Disclaimer: This article provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply. © 2019